how to beat the windfall elimination provision

The two sides have agreed to terms and the Giants have yet to make the deal official. I suppose WEP could affect others but retired militaryCSRS seems to be the target group.

Repeal Wep U S House Of Representatives

The Windfall Elimination Provision as it turns out is not some unfair penalty for teachers but simply a Feb 13 2020 0831am EST 20516 views My plan repeals these two provisions immediately increasing benefits for more than two.

. However there may still be reductions in benefits for widows widowers and other survivors but not because of the WEP. Today the WEP affects over 170000 Texans. The answer explains when. How to beat the windfall elimination provision.

The one way around the Windfall Elimination Provision that works well is to accumulate what the Social Security Administration calls substantial earnings These are annual earnings of a certain amount where you paid into Social Security in another job. I get a lot of questions about the Windfall Elimination Provision WEP what is it and how it may affect retirees. An Example of the PSP Formula in Action. The only way to avoid the Windfall Elimination Provision WEP when you are receiving a pension from non-covered employment ie.

This is the one that impacts your own Social Security benefit. Nov 09 2021 In December 2020 about 19 million people or about 3 of all Social WEPs supporters argue that the. Todays question asks if its possible to avoid triggering the Windfall Elimination Provision WEP that affects some government employees by moving to another state. Benefits wouldnt be subject to a WEP reduction until you actually claim your UK benefits though so you could temporarily avoid WEP by starting your UK benefits later than your US.

34 rows The Windfall Elimination Provision reduces your Eligibility Year ELY benefit amount before. First off please understand if you hav. They do not cover the Government Pension Offset GPO. It reduces the Primary Insurance Amount of a persons Retirement Insurance Benefits or Disability Insurance Benefits when that person is eligible or entitled to a pension based on a job which did not contribute to the Social Security.

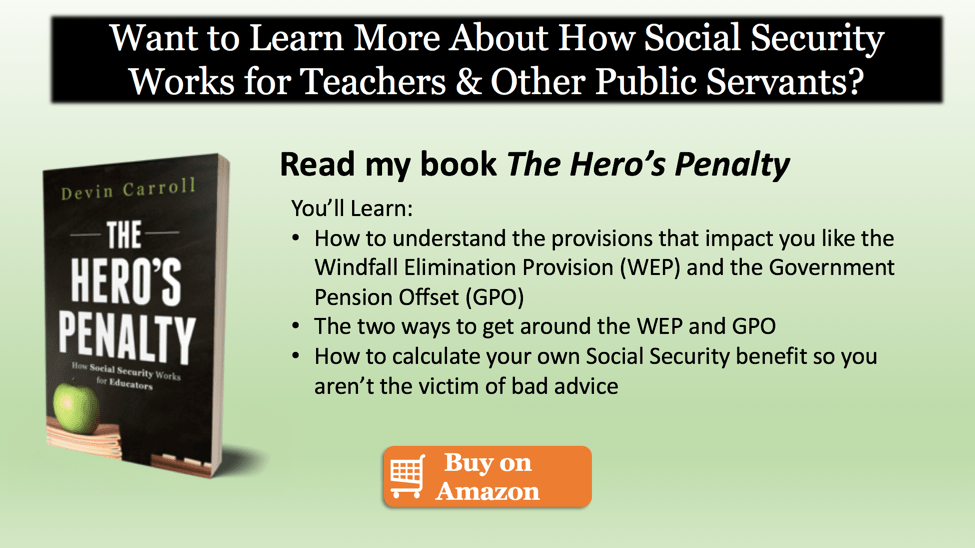

One of these exceptions occurs if you have 30 or more years of substantial earnings in a job that Social. Specifically the Windfall Elimination Provision WEP reduces a workers own Social Security benefit amount from work that they have performed. Social Security retirement benefits will be adversely affected by the Windfall Elimination Provision WEP and theres probably no way to avoid that in the long term. And when planning for.

Does anyone have knowledge of how the Windfall Elimination Provision affects the Social Security payments to military retirees who are also CSRS retirees. The WEP was originally put in place with the intention to prevent this windfall from happening. These Frequently Asked Questions FAQs provide general guidance about the Windfall Elimination Provision WEP. Multiply PIA by the ratio of AIME with all covered and non-covered earnings to AIME with covered earnings only.

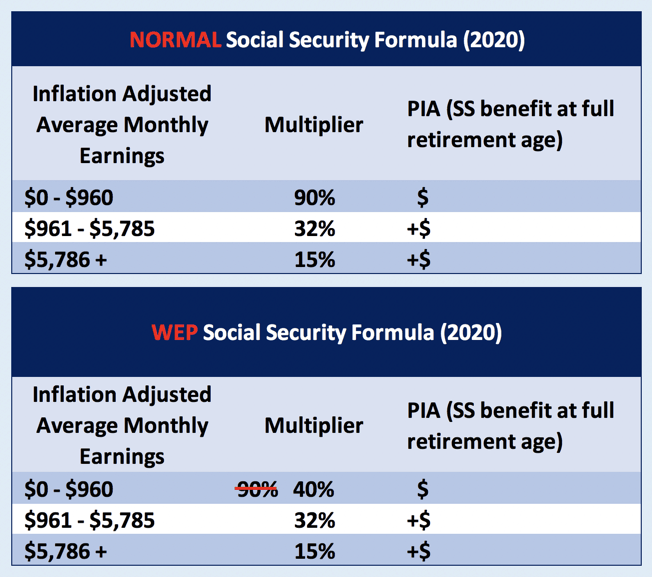

Based on your description it sounds like your US. For people who reach 62 or became disabled in 1990 or later we reduce the 90 percent factor to as little as 40 percent. Calculate the PIA using both covered and non-covered earnings with the normal non-WEP formula using 90 as the first multiplier. Does the Windfall Elimination Provision affect Survivor Benefits.

The windfall elimination provision WEP is a modified benefit formula designed to remove the unintended advantage or windfall of the regular benefit formula for certain. Home Uncategorized how to beat the windfall elimination provision. The Windfall Elimination Provision. The normal Social Security calculation formula is substituted with a new calculation that results in.

Employment for which you didnt pay Social Security taxes is to accrue 30 or more years of substantial earnings under Social Security. The Windfall Elimination Provision WEP is simply a recalculation of your Social Security benefit if you also have a pension from non-covered work no Social Security taxes paid. How to beat the windfall elimination provision Nezařazené 18. The FAQs do not address WEP issues.

Instead of creating a fair formula however the newly-created WEP forced all public servants who also paid into Social Security into an arbitrary one-size-fits-all reduction in benefits with not all public employees being treated equally. Todays question asks if its possible to avoid triggering the Windfall Elimination Provision WEP that affects some government employees by moving to another state. The FAQs assume you are or were a state or local government employee who works or worked in employment not covered by Social Security. Post Jun 19 2007 2 2007-06-20T0123.

Another rule called the Government Pension Offset GPO affects spouses and survivors. The Motley Fool Windfall Elimination Provision. The WEP is designed to offset the social security benefit for those retirees from. WEP generally affects government workers who qualify for a public pension.

Small Move Specialists Serving the Washington DC Metro Area For a Stress Free Move. If you know you will be subject to Windfall Elimination Provision it may make sense to continue to work for a few more years to reduce its effects. The WEP applies only to a workers benefits. The Windfall Elimination Provision is a statutory provision in United States law which affects benefits paid by the Social Security Administration under Title II of the Social Security Act.

Under the GPO Social Security benefits are cut by two-thirds of a pension you receive. Separate FAQs for the GPO are available here.

Unnecessary Legislation The Wep Should Not Be Repealed

Liz Weston Confused About Social Security S Windfall Elimination Provision Here S An Explanation Oregonlive Com

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

What Is The Windfall Provision For Social Security

Legislation Would Reform Social Security S Windfall Elimination Provision

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

Posting Komentar untuk "how to beat the windfall elimination provision"